Social Security Tax Max 2025

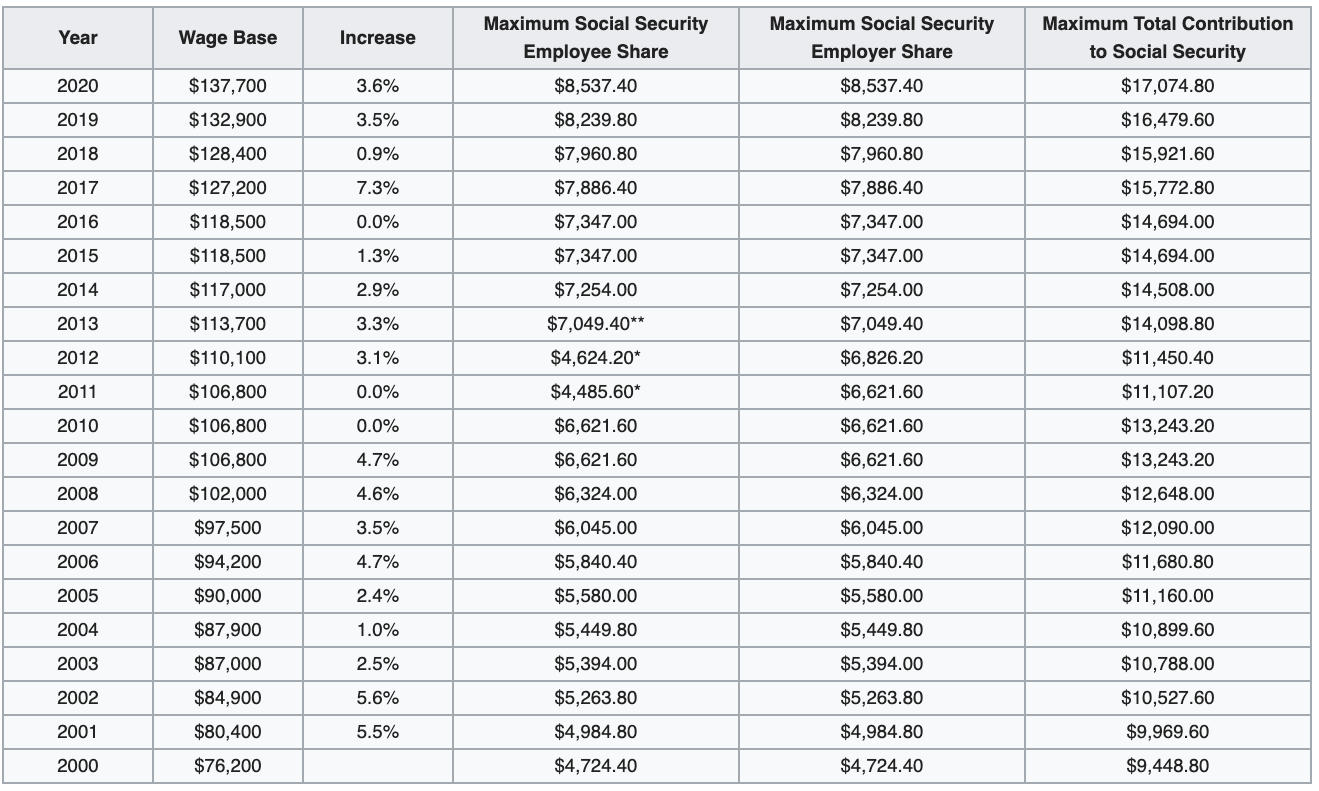

BlogSocial Security Tax Max 2025 - Only the social security tax has a wage base limit. The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

Only the social security tax has a wage base limit.

Are My Social Security Benefits Taxable Calculator, The maximum tax credit available per kid is $2,000 for each child under 17 on dec. The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration.

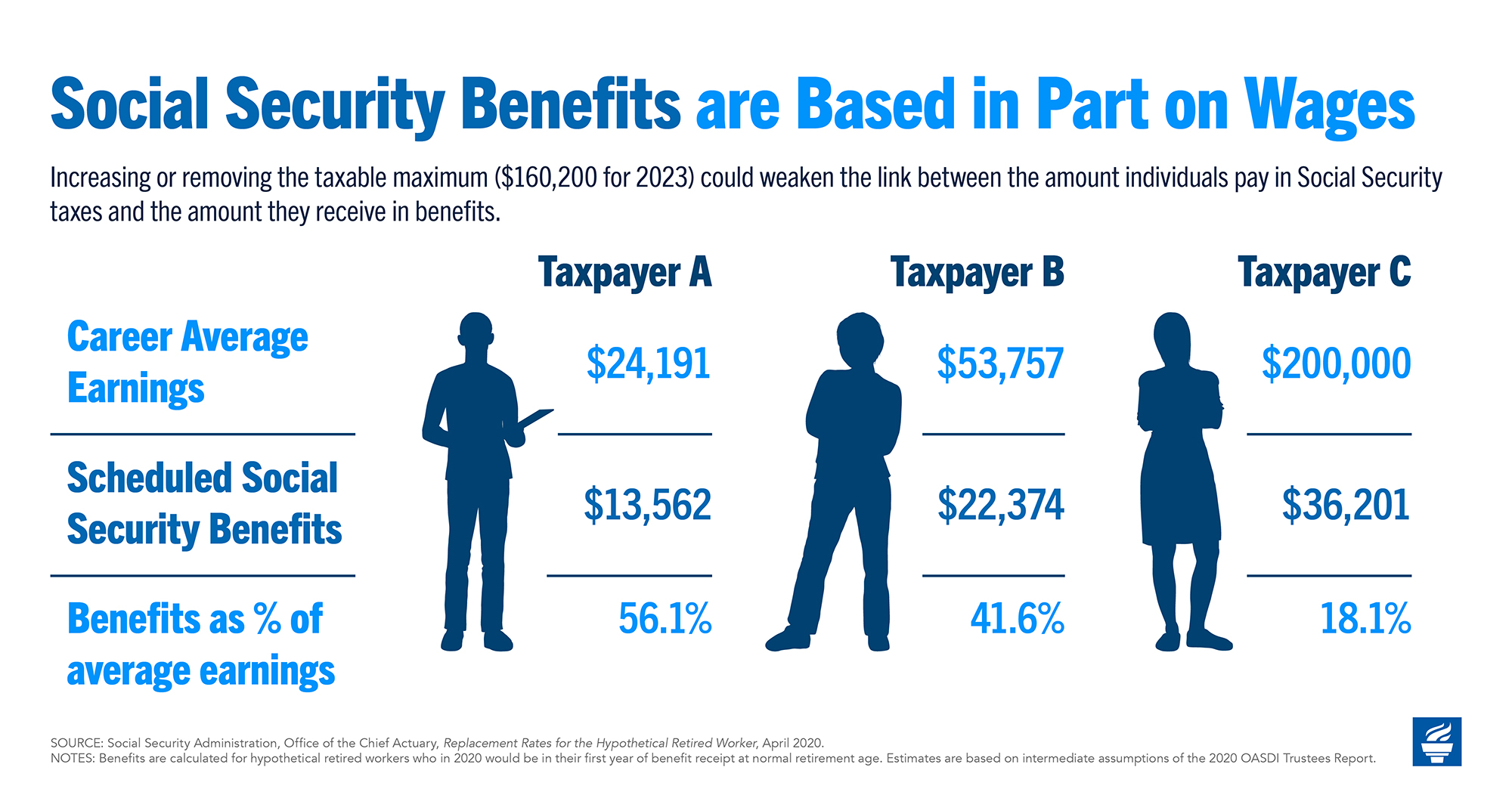

Do this during tax season to maximize your Social Security benefits, For 2023, the wage base was $160,200. If you retire at your full retirement age (fra) this year, your.

What Is the Social Security Tax Rate? The Motley Fool, If you retire at your full retirement age (fra) this year, your. The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration.

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, By law, some numbers change automatically each year to keep up with changes in price. With section 80c allowing deductions of up to rs.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

The Rich Will Owe This Much Social Security Tax in 2025 The Motley Fool, Full retirement age has changed for anyone who didn't turn 66 prior to this year. To qualify for social security in retirement, you need to accumulate a total of 40 lifetime work credits at a maximum of four per year.

Alcs Schedule 2025 Playoffs. Here is the full schedule for. Here are the updated details […]

The social security wage cap will be increased from the 2023 limit of $160,200 to the new 2025 limit of $168,600.

Social Security Tax Max 2025. As kiplinger reported, the social security tax wage base jumped 5.2% from 2023 to 2025. In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated?, The social security wage cap will be increased from the 2023 limit of $160,200 to the new 2025 limit of $168,600. To qualify for social security in retirement, you need to accumulate a total of 40 lifetime work credits at a maximum of four per year.

Social Security Tax limit for 2025 explained, The 2025 tax limit is $8,400 more than the 2023 taxable maximum of $160,200 and $61,800. 11 rows if you are working, there is a limit on the amount of your earnings that is taxed.